Week 1 - Acquisition - SearchAssist

Week 1 - Acquisition Project. SearchAssist product

The Product (Pitch)

Picture this

You’re shopping online on a popular fashion app. You start typing “black jacket Men...”. The app auto-suggests "....H&M.". Wow, a black jacket from H&M is exactly what you were looking for, you click the auto-suggested option, and the screen loads.... the excitement is palpable, and you see 186 results that match your search.

You’re eager to browse them all.

Andddddddddd... half of the jackets in those search results are not black, and none of the black jackets are from H&M.

Your shopping experience is ruined.

This is not just true for the shoppers, it's for the employees too...

percent of the workday searching for information

Looking at the larger picture, the majority of organizations implement the latest tools and solutions. However, the source content and information are scattered across disconnected platforms, making it increasingly difficult for their customers and employees to access information, products, and services. The traditional search options offer keyword-based search results and lack context.

Unsatisfied with the incomplete and non-contextual search results, users often try reaching the customer support center to resolve their queries, resulting in higher wait times and poor customer service.

But what if you had a search assistant that makes information discovery and fulfillment conversational across websites, e-commerce, customer service, and workplaces?

That is exactly what SearchAssist, by Kore.ai, does.

SearchAssist helps deliver highly relevant, accurate, contextual, and personalized search results to all users. It uses the Kore.ai proprietary technology, Large Language Models (LLMs), and Generative AI technologies to deliver next-gen search experience to various users, including employees, consumers, customer support executives, and agents.

Some of the key features of a SearchAssist application include:

- It supports ingesting data in different formats from different sources, including web pages, files, and most commonly used third-party content management systems.

- It is highly customizable, allowing you to completely control and customize the application’s response per your business requirements.

- It can be seamlessly integrated into any of your existing applications to provide an engaging user experience.

- It can be easily integrated with the most common large language models for answer generation.

The platform has over been adopted by enterprises across industries and has provided excellent results.

The user flow:

When you first visit the website, you have a convenient SSO-login option where you can quickly get started using your Google, MC, or Linkedin IDs.

The user is then taken through simple, and self-explanatory steps, followed by a bride introductory video to ensure they get an overview of the solution, and their trial plan, and that assistance is just a click away.

The app, based on our selection, either automatically creates an experience for us to preview, use and extend/customize it further, or allows us to start from scratch. Below is a tailored experience that I selected as an E-commerce executive. No matter the path you choose, you have the guidance at every step.

The entire process to set up your experience takes less than 5 minutes. You're all set!

The Buyer Personas (ICPs)

As we have seen above, SearchAssist primarily enables enterprises to enhance and improve Customer, Employee, and Support Agents' experience by allowing them to quickly retrieve the information they are looking for from a ton of information.

The use cases have been classified in a broad manner and will cover all the interactions and experiences (customer and employee/agents) that any given enterprise would look to optimize.

To categorize the use cases and the target end-users:

- E-Commerce Platforms - To enhance customer search experience and loyalty

- Workplace - To improve employee efficiency, productivity, and experience

- Contact Center - To improve agent experience, and reduce Agent efforts, and in turn AHT

- Website Search: To improve customer experience, and increase customer self-service

- This is categorized separately from E-commerce platforms, mainly due to the enterprise objectives. The website search use case is for your regular enterprises like BFSI, healthcare institutes, Airlines/Travel, Software companies, etc.

ICP Overview:

Given the use cases, we will be focusing on targeting and pursuing a specific profile within each use case, to communicate our product's value proposition, benefits, and how the product will fit into their existing infrastructure, and help them.

ICP Name | E-Commerce Platforms | Regular Website search (BFSI, Healthcare, etc) | Large Enterprise (for Employees) | Contact Center (For customers and Agents) |

Persona Position | VP, Customer Experience | Director, digital transformation initiatives / Cheif digital officer | Head, Employee Experience | Director, Contact Center Planning / Head, Customer support |

Age | - | - | - | - |

Organisational Goals | Revenue, enhance customer experience, Increase marketing ROI, | Revenue, increase customer engagement | Better employee experience, Increased efficiency | Lowering Churn, Upselling, optimizing support costs |

Role in buying process | High | Very High | Medium to High | High |

Reporting Structure | Reports to CMO | Reports to CTO | Reports to COO / CHRO | Reports to COO / Country Head |

Preferred Channels | Email, Phone, Face to Face (later stage talks) | Phone, Email, Face-to-Face | Email, Phone | Face to Face (hosting dinners, champagne tasting), Email, Phone |

Products used in workplace | Salesforce, Magento, Khoros, MS Office | Fiserv DNA, MS Office, SharePoint, Kore.ai Platform, ServiceNow, Others (undisclosed) | Google Workspace, Jira, Confluence, ADP | SharePoint, Five9 (CCaaS, and WFM), Salesforce |

Where do they spend time | Ad-Age, LinkedIn, YouTube, Gartner, HubSpot Academy | Forbes, X, ChatGPT, LinkedIn | Blogs, TED Talks, YouTube, LinkedIn | Gartner, LinkedIn, Expo Events |

Pain Points | Low conversion (app open to purchase), Low repeat purchases | Scattered Information, Complex integrations | Frequent contact with the employee helpdesk, Driving tool adoption | High AHT, High TAT, Lower CSAT (not entirely due to agents, some because of policies) |

Objectives | Improve user experience on app/website, increase conversion, increase brand awareness | Increase customer self-service, integrate data sources, establish company as digital first | Increase Employee Retention & Satisfaction Increase Employee Engagement Online | Reduce AHT, repeat contact rates, Improve agent productivity & efficiency, increase CSAT |

The Decision Panel (Segmenting the ICPs further)

As we established earlier, the product has been designed to address 4 specific use cases. We will now flesh out these ICPs, and have a decision panel for each ICP.

Each ICP target profile described in the overview earlier will have the below personas. Our communication and value prop will also consider these personas. Since we may not interact directly with the some of the panel personas, our communication, and discussion with our target profiles will enable them to address the concerns of the larger decision panel

- The Users - These are the enterprise-side developers, CMS owners and contact center agents

- The Influencers - The IT team and/or the procurement team, security team

- The Big Boss - The budget authority and the final decision-maker

Use Case and Target Profile #1 - E-Commerce (VP, Customer Experience)

Use Case and Target Profile #2 - Website Search (Director, Digital Transformation)

We want to have a chatGPT like app on our website ~ Customer Use Case Company *

*= Said by a prospect to sales team, as part of the solution requirement

Use Case and Target Profile #3 - Large Enterprise (Employee Use Case | Director, Employee Experience)

Use Case and Target Profile #4 - Contact Center (Director, Contact Center Planning)

APPENDIX - ICP Prioritization by factoring in the end-user (as per the framework)

As mentioned earlier, the product is built with specific use cases in mind. That means one level of prioritization has been done, allowing us to target all the ICPs via the product use cases. Therefore, it didn't feel right to run the ICP framework as-is to our ICPs.

However, as a form of experiment, we have utilized the framework as-is, and we have tried to prioritize our ICPs or buyer companies, based on the end-users. We have applied a few parameters like adoption curve, Frequency of use case to our product's end-users i.e., Ecommerce customers, Employees, and contact center agents, while the other parameters have been applied to the buyer companies.

ICP Prioritization based on the end-user (as per the framework):

Based on the ICP Prioritization Framework on the end-users, we see the following:

- Adoption Curve (applied to end-users): The Curve is relatively higher for employee use cases. This is primarily because the employees are fixed in their ways, and the user adoption is highly dependent on how the internal team pushes the solution within the organization. It is likely that the ROI, or the visible value, will only be seen in much later stages.

- Frequency Of Use (applied to end-users): The frequency of use is very low for employee use cases while high for customer and support agent use cases. The customers and support Agents will be using the solution for every purchase or every contact resolution, respectively, whereas the enterprise employee may use it occasionally when they want to know policies on insurance claims, Travel, reimbursement, etc, which are not daily occurrences.

- Appetite to Pay: Given the enterprise level, all the buyer persona companies have the appetite to pay. However, the potential ROI may comparatively be lower for Employee use cases

- TAM: The global market for Enterprise Search is estimated at US$6 Billion currently, and is projected to reach a revised size of US$12 Billion by 2032. However, this figure is mainly driven by the E-commerce and enterprise market. The enterprise employee use case will also increase, however, at the given product stage, this is not the ideal ICP to prioritize

- Distribution Potential: With high frequency of usage, and existing success stories in these domains, the e-commerce, website search and contact center use cases should be prioritized at this stage. Also, a successful deal closure in these domains will have a bigger multiplying effect and would help us attract similar organizations and shorten the sales cycle for future deals.

ICP Name | E-Commerce Platforms ✅ | Regular Website Search (BFSI, Healthcare, Retail) ✅ | Large Enterprise (for Employees) ❌ | Contact Center (For customers and Agents) ✅ |

Adoption Curve | High | Low to Medium | Higher ❌ | Lower |

Frequency of Use | High | High | Low ❌ | Very High |

Appetite to Pay | High | High | High | High |

TAM | High | High | Medium | High |

Distribution Potential | Very High | High | Medium | High |

Based on the above points, we will be prioritizing three use cases for the SearchAssist Applications.

- E-Commerce - Customer-Facing Use Cases ✅

- Website Search (BFSI, Healthcare, Retail) - Customer-Facing Use Cases ✅

- Contact Center Search - Support Agent Facing Use Cases ✅

The Market

The global market for Enterprise Search, estimated at approximately US$6 Billion currently, is

projected to reach a revised size of over US$12 Billion by 2032

It should also be noted that the underlying conversational AI market size is projected to grow to approx. US$ 32 Billion by 2030.

Competitor Analysis

The enterprise search market is getting too crowded in recent times, with many big and small players trying to scale within this space. Some of the tools that SearchAssist is competing against include, but definitely not limited to:

- LucidWorks

- Coveo

- Algolia

- Amazon Kendra

- Searchspring

- Glean

- Sinequa

So, what differentiates SearchAssist from others?

SearchAssist is the World’s First Cognitive, Conversational and Complete Search Assistant. It provides a unified search + chat interface. In its unified interface, it provides the best of both worlds, with relevant results by taking into account a user’s journey across the website.

In addition, SearchAssist:

- It is the only solution to provide contextual transfer to live agents. It does not simply rely on automation but brings in a human touch where needed.

- Is the only solution to provide an evolved approach to RAG (Retrival Augmented Generation), generating a response in <3 Seconds, significantly faster than others

- Provides Intelligent extraction of FAQs from documents, such as PDFs, using pre-trained models

- Is backed by Kore.ai's proprietary technology. Kore.ai is the leader in the conversational AI platform category

Calculating TAM/SAM/SOM

As we saw earlier, the global market for Enterprise Search is

- 2024: ~$6 Billion USD

- 2032 (Projected): $12.2 Billion USD

Geographies:

Kore.ai is headquartered in the U.S. and has a presence in Europe, India, Japan, Korea, Australia, LATAM, the Middle East, and SEA regions as well. In terms of geographies, Kore.ai serves all global regions. Also, the SearchAssist application inherently is not industry or domain-specific, and can be implemented for any enterprise looking for an enterprise search solution.

TAM:

The solution is industry and domain-agnostic, and Kore.ai, as a company, has a global footprint and currently serves all industries across the globe.

Basis this, we can consider the TAM to be the entire market size of $6 Billion currently, which will then increase to $12.2 Billion USD in the coming years.

There is no regional prioritization for Kore.ai as its presence is strong across all adressable regions.

SAM

The product and the company have no restrictions in terms of industries or regions to target, and we can address the total market size. However, give that the product has found market validation and has secured an initial set of customers, across all industries, and is now in the early-scaling stage, we should now be looking to strengthen our position in the enterprise search category and increase the the avg. deal value. This is possible when we target our ICPs, primarily within the mid to large scale enterprise segment, that have relatively higher volumes and credibility in their respective industry.

Of the TAM, since our focus is on prioritizing the mid to large-scale enterprises, we are making a conservative assumption that these companies cover up to 75-85% of the market size.

The BFSI, Healthcare, and E-commerce platforms are expected to maintain their top positions across the projected period (till 2032). However, assuming that their position dips, we can expect the market size of our ICPs to fall by 7-10% by 2032. That gives us:

SAM (in 2032) = 75% of market size = $8.54 Billion USD (2032)

SOM

With the current rise of LLMs, and Generative AI, we are seeing that there are many new companies and industry veterans entering the enterprise search market. On the other hand, given the product is just a year-old, and there is a growing market segment, we do not have conclusive data on how much is the market share for SearchAssist at this point.

However, Kore.ai, as a company, has a market share of ~2.5% in the conversational AI landscape. If we were to apply the same percentage of market share, plus the benefit of upsell opportunity to the existing 350+ customer base of Kore.ai, we could conservatively assume a market share of 5-6% for the SearchAssist application.

SOM (2024) = 5% of ~$4.08 Billion USD = Approx. $200 Million USD

With Kore.ai already a leader in the market and its continuous focus on R&D, they have brought in differentiating capabilities for the SearchAssist application, like unified search + chat, RAG, etc. Considering that the progress from a technology standpoint would continue at the same pace, if not increase, Kore.ai, as a company, will see the market share rise from 5% to 8-9% by 2032

Taking the conservative 8% for SOM

SOM (2032) = 8% of ~8.54 Billion USD = $680 Million USD

Channel Selection and Experiments

Current Acquisition Channels:

This means that while our SearchAssist application is in the Early Scaling stage, the Kore.ai brand and its primary platform are in the mature scaling stage and have been doubling down on the acquisition channels that have provided the results. This also helps in pitching SearchAssist to prospects and existing customers as well.

Given that the company operates in the B2B SaaS arena and caters primarily to enterprises, the acquisition is primarily driven by the sales channel, but the leads have been generated by a mix of other channels as well, such as

- Organic (SEO + Blogs + Webinar)

- Content Loops (Organic, but considering a separate channel to prioritize)

- Paid Acquisition (SEO + PR)

- Industry/Domain Events ( Paid Channel, but considered a separate channel due to the effort)

- Earned Media (Analyst Recognition; Gartner, Forrester, IDC, etc.)

- Partner Program

Acquisition Framework:

Before we dive into the acquisition framework, we see that while Kore.ai has covered all acquisition channels, the product’s extensibility and the pre-built integrations provide us the scope, i.e., whitespace, for us to experiment with a new channel, which is Product Integration.

Therefore, along with existing channels, we would also introduce Product Integration as part of the acquisition framework. Please note that these channels should be treated primarily as lead generation channels, which will allow the sales team to jump in and drive the opportunity forward

Based on the channel framework and the scope for experiments, we will be prioritizing the following channels for the current stage of acquisition.

- Organic Channel (SEO + Blog)

- Content Loops

- Product Integration

Does this mean the other channels are not worth prioritizing?

NO. The reason we're prioritizing these 3 channels is that they are low-cost and are not being utilized currently to the full extent. In addition, Kore.ai has all the resources to afford experiments across these channels. The other channels, such as industry events, earned media, partner programs, paid ads, etc. are already being put to use by Kore.ai for their other products, and the platform created can simply be used for SearchAssist as well. It would not make sense to build the entire cycle on these changels just for one product module.

So, these 3 channels will allow us to maximize the return on top of the current channels that are in use already.

The WHY?

- ✅Organic Channel: Enterprise search has been gaining traction, and there has been an exponential rise in the past year itself. While the enterprise search as a category has been around, the traditional search mechanism is no longer going to be attractive. A significant reason for this is the exposure to LLM-powered app experience. Due to this LLM-experience, companies are expressing genuine interest and are looking for a 'conversational search' experience. Our website/content optimization should be focused on this differentiating factor.

- ✅ Content Loops: The enterprise search market is undergoing a transformation. With Generative AI as the benchmark, customers expect that any software/tool that they are interacting should provide similar results as your GenAI tools would. Leveraging this trend/insight, we will be creating content loops and showcasing product functionalities that have the shareability aspect.

- ✅ Product Integrations: The product is highly open and extensible, and already has the pre-built integrations with all the popular enterprise business systems. For this experiment, we will be leveraging the extensibility, and list the product on marketplaces which will make it more accessible to enterprise users, or to the least, help increase brand awareness.

The Experiments:

#1 Organic Channel (SEO + Blog):

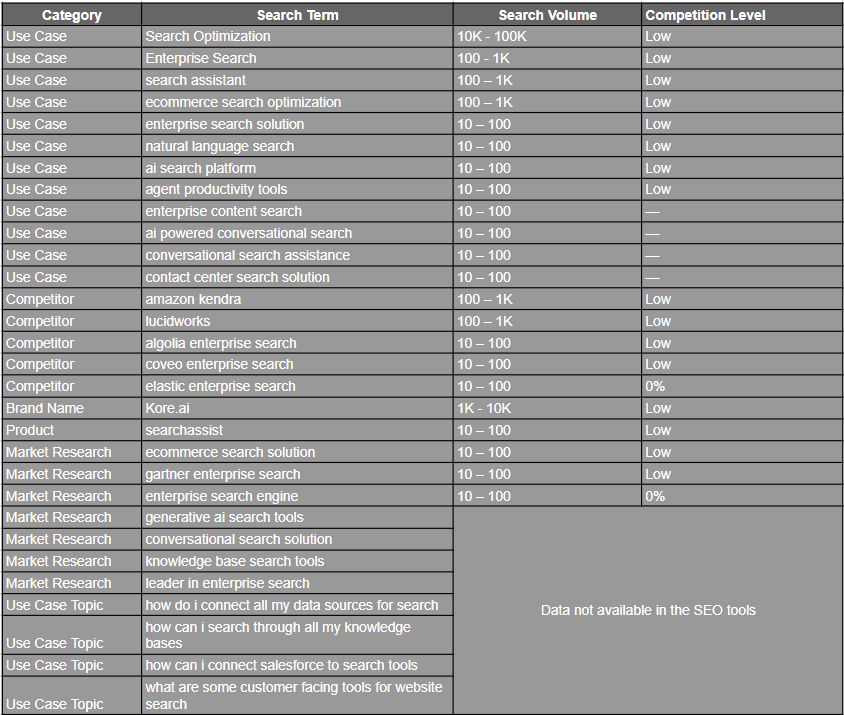

Following are the current search trends (last 30 days) pertaining to the enterprise search category. The monthly average has remained more or less the same over the last 12 months.

While the search volumes may be low, but they are considerable, given how specific the problem the product is trying to solve.

The question is, are we fulfilling the search intent currently?

NO

Out of all the search terms that have significant search volume, SearchAssist does not feature in any related search topics unless and until we search for a very specific keyword .i.e, "conversational search assistance" In fact, even when you search for the industry term "Enterprise Search", the product does not appear anywhere.

Similarly, when we search for the competitor names, there is no sign of SearchAssist even in the entirety of Google search results first page.

Next Steps:

As we have seen, the SEO for the SearchAssist product is currently weak. While we're not saying this is our primary acquisition channel, having a presence allows us to create brand awareness and generate leads that can then be fed into the sales pipeline.

- Optimize website content: We need to go strong on some of the popular keywords including the industry term 'enterprise search' and the competitor name search. This will feature us among the other players and give us visibility.

- Blogs: There are just 3 blogs related to the product, and none of them appear in the search results. We should create a new series of blogs purely to educate our prospects on how the enterprise search is evolving. In the second set, we should have articles highlighting the differentiating factors, and adding scenario-based issues that our ICPs currently face, and how SearchAssist is designed to solve them

In addition, given that the Enteprise Search is a category in itself, our content will help us establish and get the credibility to then participate in the 'Earned Media' channel, .i.e, Analyst recognitions

Current Blogs on website

- Why Conversational Search Matters for Elevating Digital Commerce and Workplace Experience

- Why AI-powered Enterprise Search is Critical for Augmented Employee Experience

- Reinventing Retail with Conversational AI Search

Blog Recommendations (experiments) for the second set:

- Tackling high AHT in your contact center - educative content, with SearchAssist plug

- How can you make your shoppers' experience better - UI/UX design tips, with enterprise search mention

- Help your support agents find information faster

- The impact of enterprise search on costs and efficiency

#2 Content Loops

The objective of this entire exercise is to 'Create the buying Intent', or in this case 'Create the interest'

Before we create content loops, we need to understand where our ICPs are spending time. One common link that we can see in our ICPs is that they are active on LinkedIn, and that will be our preferred channel here.

Content Loop | Hook | Generator | Distributor | Secondary Channel |

|---|---|---|---|---|

30-60 Sec video on LinkedIn |

| Kore.ai in-house team |

| To be played on booth screens during expo/summit |

Blog | ICP Targeted articles | Kore.ai team | Through SEO, and LinkedIn | - |

Content Loop Details:

Content Creation:

Create engaging 30-60 sec video for relevant use cases that will allow prospects/viewers to relate the content generation to popular GenAI tools. The key here is to make them relate, not compare.

Examples Video Content:

An E-commerce app/website background

User: Show red lipstick below $10

SearchAssist: There are different shades and brands available. Is there anything specific you're looking for?

User: idk...Maybelline I guess

SearchAssist: Maybelline red lipstick is available. Here are few options - shows options

User sees options > finishes the selection process in chat/product screen > proceeds to payment > completes transaction.

Content Distribution:

The content will be shared first by the Company, and also by the executive leadership team on their LinkedIn pages. The post will also have a CTA, asking people to try out the product for free, and create their own experiences. If needed, a share button can also be created within the tool encouraging users to share a snippet of their conversational flow.

Kore.ai employees will also be encouraged to repost the content. Kore.ai has close to 1000 employees, and an average of 500+ connections each. A conservative 20%-30% actually like/repost the video content on LinkedIn. In addition, AI enthusiasts also like or repost the content organically.

Reiteration and feedback:

As employees engage with the content and share the free trial CTA, their connections see and interact, expanding the reach.

- Use insights to refine future content

- Also, respond to conversations under the videos to nurture the potential customers

- Also, we will encourage users who sign up to share their experiences and content

The shared content, if it has the potential, will then again be reposted by Kore.ai company page and employees will reshare and like the reposted content, sparking conversations, and the feedback process. Also, we create newer video content using the insights.

#3 Product Integrations

Given that its a B2B SaaS product, I believe it does not matter where our ICP is spending time as per their interest. We have to look it in this way - where can our product be integrated, and if it can be integrated with say ABC, are my ICPs aware and use the ABC platform, will ABC actually help me scale my product or create awareness.

In the case of SearchAssist, there are two such integrations that can be explored:

- Salesforce AppExchange

- Atlassian Marketplace

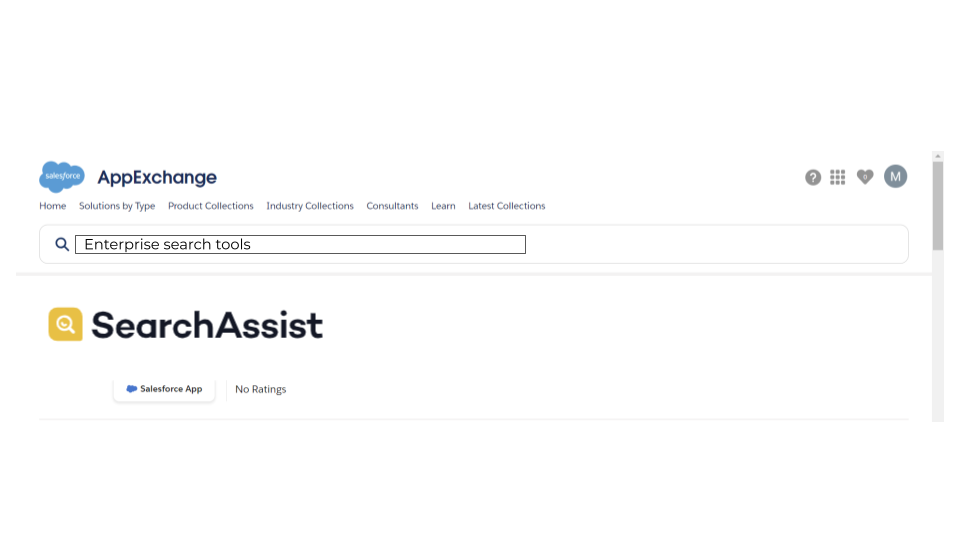

However, we will prioritize Salesforce AppExchange for now, and expand to other platforms as we grow further. We are prioritizing AppExchange because of the visibility that it would provide.

Search landing page:

How Salesforce AppExchange will help SearchAssist:

- Salesforce has more than 150,000 customers, and moreover, at least 2 of our target ICPs also use Salesforce as their preferred business system.

- Discovery

- Our target ICPs with an intent to solve their info discovery and retrieval problem, would look for a solution first within their existing product's ecosystem. This is because they have invested heavily in their CRM, and other systems, and will not want to switch

- Within the AppExchange marketplace, SearchAssist will be listed as a productivity app for appropriate SF modules. The product will also be recommended if the user search criteria is matched.

- Product Page:

- The product page will have detailed description, technical details, and an install button

- It will also have demo videos available

- Install vs. watching demo:

- If the user decides to install the app, there will be no flow blockage. They can simply choose the appropriate account and complete installation

- If the user wants to just watch a demo, they can, however, we will prompt the user to submit the pre-filled user detail form, as a way of lead generation. In case the user does not install after watching the demo, our BDRs will reach out to them for assistance and nurturing.

- Value?

- Users downloading from Salesforce will have a seamless transition, and a pre-built integration they can leverage

- They can simply connect their knowledge base, index it and get started

- They will have value realization, without spending a cent, with our 90 day free trial

- Post-Installation (or trial):

- Relevant teams will reach out to the customer to provide assistance, and guide them so that they don't abandon the trial, and get the maximum value

- Once they start seeing the value, sales team to initiate discussion, and convert it to a real opportunity (single or mult-year contract)

Demo Page:

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.